When Will Wmt Stock Split Again

Commodity Thesis

Walmart Inc. (NYSE:WMT) has turned from a depression-growth brick-and-mortar pureplay trading at an inexpensive valuation into a company with a significant east-commerce business. This has helped propel the stock upwards, but on the other mitt, an to a higher place-boilerplate valuation limits Walmart's future upside potential to some degree. Overall, Walmart does not look like a bad option at current prices, yet, and the company'south resilience versus recessions and other external shocks is a major plus in uncertain times.

What Is The Short-Term Future Outlook For Walmart Stock?

Walmart Inc. has seen its shares climb a fiddling more than 100% over the concluding five years, every bit the market place increasingly recognized the visitor as a major player in the online retail infinite. The company's performance during the first phase of the coronavirus pandemic was excellent, equally shares traded at a higher cost in Apr 2020 compared to the beginning of 2020. This was, of course, the effect of strong operating performance, equally consumers stockpiled goods during the start of the pandemic, while investors also pushed into safety-haven stocks such as Walmart in a flight-to-safety.

The strong operation during the offset phase of the pandemic in H1 2020 did outcome in a relatively weak share toll performance over the following year, nonetheless. Today, Walmart trades only 15% above where shares traded a year ago, which is a significantly worse 12-month return compared to the South&P 500'south (SPY) gain of 32% in the aforementioned fourth dimension. The caption for this is that Walmart, due to a much stronger performance in H1 2020, had a more limited upside compared to the broad market, which all the same had to recover from previous losses.

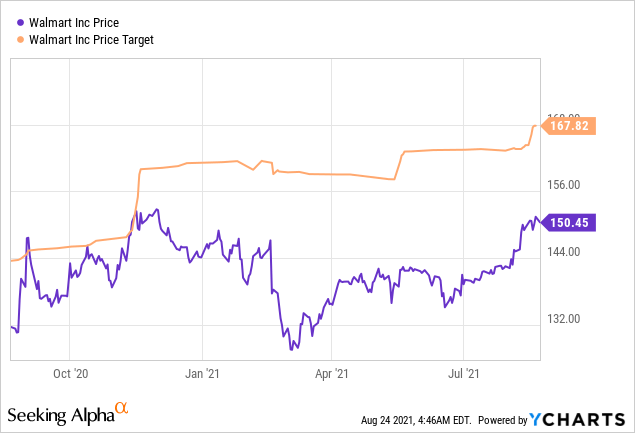

At $150 per share, the about-term outlook for Walmart is neat, just not excellent, either:

Shares do accept an upside of effectually x% from the electric current price towards the consensus analyst price target of $167. Usually, price targets are given with a 1-twelvemonth horizon, and then analysts do see a low-double-digit upside over the side by side twelve months. There is, of course, no guarantee that this price target will be hit, as annotator models may prove to be too optimistic.

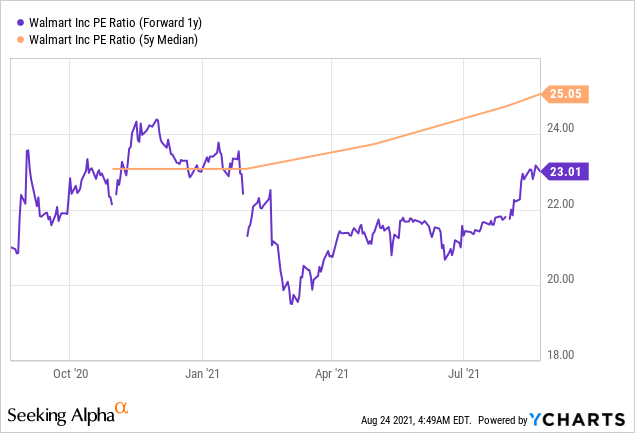

Looking at Walmart'due south nigh-term upside from a valuation perspective, we get a similar picture. If things become right, there'southward some upside potential, but huge gains are not very likely:

Walmart trades at a 2022 earnings multiple of 23 correct at present, which represents a modest discount compared to the 5-year median earnings multiple of 25. If Walmart hits the consensus EPS judge for 2022, it would have a high-unmarried-digit upside potential if shares were to merchandise at 25x internet profits a yr from now, which would be in line with the average over the final couple of years. There are, of course, potential risks, such as an EPS miss, or the fact that the marketplace may decide that the 25x earnings multiple from the contempo past was a little besides high. Even at 23x next year's profits, Walmart, which is still a heavily brick-and-mortar focused visitor, is far from cheap, which could limit Walmart'due south upside potential. It should exist noted that Walmart'southward longer-term (10-year) median earnings multiple is 16, shares are thus trading well above that level right at present. Walmart's 10-year median earnings multiple is, even so, only partially comparable to the company's current situation, every bit Walmart was not seen as a major due east-commerce role player a decade ago, and valuations across equity markets, in general, were lower back so. I thus practice not expect that Walmart reverts back towards that multiple, but investors should notwithstanding consider the fact that shares trade well higher up the longer-term boilerplate right now.

If the current Delta wave of the coronavirus pandemic continues to worsen, investors may exist inclined to push into safe-oasis stocks once again. Like to what happened in H1 2020, this could be beneficial for Walmart's share price, as its shares would be seen as a more than resilient store of value compared to more cyclical industries such as energy.

Where Volition Walmart Stock Be In 10 Years?

In the near term, sentiment can bulldoze share prices to a large degree, but in the long run, fundamentals and underlying profits are more important. Walmart had a peachy 2020, cheers to stockpiling by consumers and more at-abode consumption (less dining out), which resulted in attractive comparable sales growth for Walmart. The tough comparisons due to the ane-fourth dimension impacts seen in 2020 will atomic number 82 to below-average growth in 2021, but investors shouldn't worry about that as well much, as this will be a 1-time issue as well. Profitability volition likely increase significantly this year and in 2022, as the pandemic-related one-fourth dimension expenses will be less of a factor this year and across, which should issue in some margin expansion for Walmart.

In the long run, Walmart has the potential to grow its revenue at a mid-unmarried-digit step, I believe. The core concern will benefit from inflation and perhaps from some productivity gains and should be able to abound aforementioned-store sales at a low-single-digit pace in the long run. Shop openings are not a meaningful growth commuter for Walmart, simply the visitor's e-commerce concern should grow at a significantly faster step compared to its brick-and-mortar stores. Overall, the above-average online sales growth will thus lift the visitor-wide growth rate, which volition allow Walmart to abound its top line to $650+ billion by 2027 -- if the analyst community is correct. I believe that this estimate might prove to be a lilliputian bourgeois, every bit factors such as above-average inflation (which would push button up comp sales growth in nominal terms), acquisitions, etc. could lead to higher-than-expected sales growth.

Apart from sales growth, Walmart will also see its profitability benefit from other factors. As east-commerce/omnichannel sales are ramped upwards, those should go more profitable over the years, due to operating leverage and as efficiency gains can be fabricated equally processes are refined. Operating leverage should also be benign for profitability in Walmart's cadre portfolio, every bit comp sales continue to climb over the years.

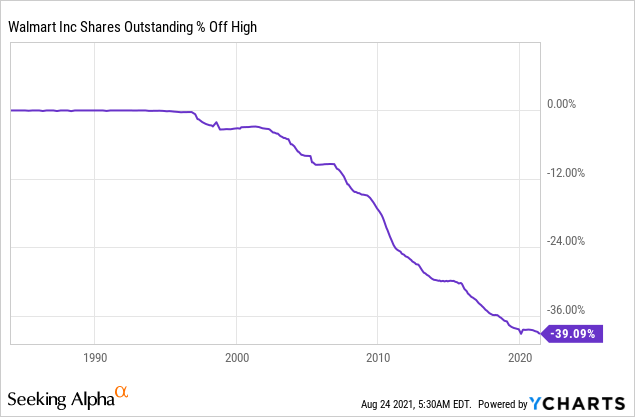

Walmart besides has been an avid heir-apparent of its ain shares in the past:

The company seems to be willing to continue with that at current share prices, as Walmart bought back $five.ii billion worth of shares in H1 of the electric current fiscal year, which equates to an almanac buyback pace of more than $10 billion. Thank you to its strong free cash generation -- despite heavy investments in its stores and omnichannel offerings -- Walmart could thus buy dorsum about 3% of its shares per year, which will naturally accept a considerable impact on earnings per share growth in the long run.

Analysts are forecasting earnings per share of $half-dozen.thirty for the current fiscal year, and that amount is forecasted to grow to $x.fourscore by January 2031. This pencils out to an almanac growth charge per unit of around 7%, which is non outstanding, but very solid. Since ii%-3% of that volition likely come from buybacks alone, revenue growth and margin expansion would only accept to deliver ~4% annual profit growth, which seems similar a very achievable goal, I believe.

If Walmart manages to earn $10.80 in 2030, the question is where its shares might merchandise if that happens. At a 25x earnings multiple, Walmart would exist worth nigh $270 per share by and so. I practice, however, believe that there will be some multiple compression over the coming years. Interest rates will likely not remain this low forever, and Walmart volition likely be seen as less of a safe-haven stock one time the pandemic has concluded. A somewhat lower valuation, compared to the electric current 25x earnings multiple, thus seems like a realistic base case assumption to me, although I exercise non believe that nosotros will come across shares trade down at mid-teens earnings multiples as they did in the past.

If Walmart were to trade at 20x internet profits a decade from now, its shares would be valued at $216 by the terminate of 2030. Compared to the current share cost of $150, this equates to an upside potential of ~45%, or 4% annually. Add in Walmart'due south dividend, which currently yields 1.v%, and investors can expect annual returns in the 5%-vi% range if my scenario is right. This would be far from bad, compared to treasuries that offer a ~ane% almanac render, and when we consider that Walmart is a relatively safe, anticipated, depression-risk stock. On the other paw, withal, mid-single-digit annual returns aren't especially great, either, and many investors will have a higher hurdle rate when investing in equities.

Information technology is possible that Walmart trades at a different valuation in 2030, of course, and these projections may turn out to be too conservative or too optimistic. But I believe that mid-single-digit almanac returns from Walmart through 2030 brand for a realistic base case assumption.

Is Walmart Stock A Purchase, Agree, Or Sell Correct Now?

In case you observe the higher up scenario unrealistic, yous may decide differently, but to me, Walmart does neither seem like an especially attractive buy correct here, nor practise I believe that shares are a sell or avoid. Instead, with solid but unspectacular expected returns and because the stock's below-boilerplate recession vulnerability, Walmart seems like a hold to me correct at present.

Deploying new money hither, at a 25x earnings multiple, does not seem similar an attractive proposal to me. In instance the Delta variant makes COVID reemerge in a very large manner in the coming months, its rubber-haven nature could however result in share price gains, and as noted above, analysts are also predicting some gains over the side by side year.

Is This an Income Stream Which Induces Fear?

The principal goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to class an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your gratuitous ii-calendar week trial today!

The principal goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to class an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your gratuitous ii-calendar week trial today!

Source: https://seekingalpha.com/article/4451641-walmart-stock-10-years-outlook

Belum ada Komentar untuk "When Will Wmt Stock Split Again"

Posting Komentar